Home Research & Data

Research & Data

Analysis of the latest commercial real estate lending data, provided by CBRE, shows debt terms are favourable for sponsors.

Global investors are targeting debt as well as opportunistic and value-add investing, the consultancy says.

To test the mood of the European commercial real estate market, Real Estate Capital teamed up with the Commercial Real Estate Finance Council Europe to publish its first sentiment survey of the sector.

Debt funds drove hiring activity across the European real estate debt market in 2018, research from Paragon Search Partners shows.

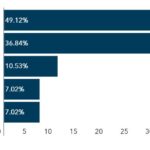

Non-performing loan activity keeps growing in Spain, Italy and Portugal while sales in Europe reach record levels, according to Evercore.

The European loan sales market reached new heights last year, with €113.8bn of non-performing loans been sold, according to Evercore.

Capital raised for real estate debt funds with a European focus fell to $5.74bn last year – down 46% from its 2017 high, Real Estate Capital data show.

The Real Estate Finance unit of Link Asset Services, which is launching its third survey of the UK property lending market, expects banks to be more cautious as Britain’s exit from the EU nears.

Data published during the year reveal relatively stable European financing conditions and a revived CMBS market.

The total cost of senior borrowing increased in Q3 2018 across the whole of Europe, excluding three markets, CBRE’s European Debt Map shows.