Home Lending

Lending

The continued volatility in European markets is providing opportunities for those with expertise, says Apollo Global Management’s Ben Eppley.

For the alternative lenders participating in Real Estate Capital Europe’s roundtable, market conditions seem conducive to grow their loan books. But the apparent opening is not without complications.

Lenders are bridging the finance gap – but only if borrowers show evidence of a sustainability plan.

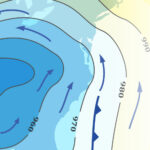

BF.direkt’s latest sentiment survey shows tightening credit conditions as Europe’s operating conditions worsen.

Regional bank failures and vacant offices are causing concerns about the US financial and real estate sectors. Europe’s property finance professionals are watching and considering the implications for their markets.

Equity-focused managers tell the PERE Europe Forum they are increasingly considering lending strategies.

The manager has raised €1.2bn for European-focused debt opportunities as volatility persists

The Frankfurt firm, which has assets under management of €1.4bn, had previously put ambitions in the lending market on hold.

The consultant, at its latest annual address on financing property, said it also expects an uptick in transaction volumes in H2.

The London firm, which sold a 31% stake to Candriam Group earlier this year, plans to launch a successor to its TIPS One fund in Q3.