Home Banks

Banks

Rising interest rates, CMBS volatility and the likelihood of higher spreads are among the factors borrowers in the US need to think about, writes Ryan Krauch of Mesa West Capital.

Industry figures at the annual Cannes gathering predicted another strong year for real estate, but acknowledged threats including Brexit and slower eurozone growth.

Analysis of the latest commercial real estate lending data, provided by CBRE, shows debt terms are favourable for sponsors.

Lenders are keeping Europe’s property market financially liquid, despite Brexit and the extended nature of the current real estate cycle, argues Nassar Hussain of Brookland Partners.

Britain is in dire need of residential development. Debt providers can play an important role in supplying the necessary finance.

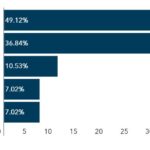

To test the mood of the European commercial real estate market, Real Estate Capital teamed up with the Commercial Real Estate Finance Council Europe to publish its first sentiment survey of the sector.

Executive search firm Sousou Partners has exclusively shared with Real Estate Capital a comprehensive pay scale of the commercial property debt industry.

Retail property values are falling, forcing lenders to question their exposure to the sector.

The organisations and deals voted last year's best can be announced at long last.

With many lending organisations’ origination parameters limited, experienced staff are being attracted to roles as debt intermediaries.