Home Banks

Banks

Debt providers including Hudson Realty Capital, ACRES Capital, Archway Capital and M360 Advisors have expanded, or are looking at ways to grow, their product offerings.

Hanno Kowalski, managing partner of the Berlin-based debt provider, says demand for junior loans against core assets means mezzanine lenders, and their investors, are taking less risk.

The high-profile departure comes two years after the New York-based bank’s reorganisation of its property businesses.

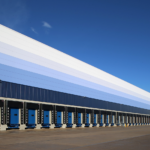

The bank’s head of real estate for Iberia says the high quality of the Montepino Spanish logistics portfolio acquired by Bankinter Investment convinced it to provide a €470m loan.

Ali Otmar of Tristan Capital Partners and Ben Eppley of Apollo Global Management discuss a transaction, which Otmar says required the 'extreme end of flexibility'.

Panellists at CREFC Europe’s conference on offices say lenders are factoring in capex programmes and shorter leases when underwriting properties.

Following the bank’s €400m refinancing of a pan-European logistics portfolio for GLP, its managing director for special property finance says funding for multi-jurisdictional transactions is scarce.

Louise Gillon, head of hotel finance at lender Leumi UK, says she is confident in long-term demand for high-quality accommodation in city centre locations.

Commercial mortgage-backed securities issuance in Europe is gaining traction, with six deals launched so far this year.

The report, compiled by The Business School, formerly known as Cass, reveals new UK lending dropped 23% to £33.6bn in 2020.