REC staff

Aviva Investors considers a new target after writing £1 billion of sustainable loans; Blackstone Real Estate Debt Strategies takes the development financing route to logistics; Nuveen plans to lend to emerging managers; and more in today’s briefing, exclusively for our valued subscribers.

Asset manager DWS notes strong investor demand as it holds a first close on its junior debt fund; French bank Natixis says Europe’s lending market is weathering political and economic uncertainty; mega-manager Brookfield is deploying capital as quickly as it can raise it; and more in today’s briefing, exclusively for our valued subscribers.

Cain International’s £261.5 million (€306 million) loan highlights the lending opportunities in the content creation industry; the latest Bayes report reveals a bumper year of lending in the UK in 2021; QSix targets larger loan deals after securing lending mandate; and more in today’s briefing, exclusively for our valued subscribers.

Apollo Global Management’s financing of LaSalle Investment Management’s UK outlet malls purchase signals lender appetite for high-end out-of-town shopping; Germany’s Berlin Hyp puts its focus on the S of ESG with its latest covered bond; a single-family rental financing in the UK market suggests lender interest in the residential sub-segment; and more in today’s briefing, exclusively for our valued subscribers.

CBRE Investment Management cites a long-term outlook for senior lending as it launches its new UK fund; Allianz Global Investors achieves a rapid first close for its debut real estate private debt fund; US manager Marathon Asset Management’s UK subsidiary joins forces with specialist lender Hilltop Credit Partners to provide residential development loans; and more in today’s briefing, exclusively for our valued subscribers.

Aareal Bank’s €360 million retail parks loan demonstrates lender appetite for the well-performing retail sub-sector; an ING and Bank of America-led financing shows lender support for data centres; CBRE Investment Management’s latest research suggests Europe’s green upgrade could require more than €300 billion of capex debt; and more in today’s briefing, exclusively for our valued subscribers.

Cheyne Capital’s financing of Riverstone’s Kensington scheme heralded as the UK’s largest single-asset later living sector debt deal; Berlin Hyp’s latest loans highlight the circumstances in which banks will finance offices; Andy McDonald to lead HSBC UK’s real estate business as Sharon Quinlan takes Asia-Pacific role; and more in today’s briefing, exclusively for our valued subscribers.

UK asset manager abrdn taps investor demand for senior real estate debt with £1 billion fundraising target; a fresh bid by US private equity firms for German bank Aareal wins over some shareholders; BNP Paribas Asset Management’s acquisition of a Dutch manager gives it exposure to the mortgage market in the Netherlands; and more in today’s briefing, exclusively for our valued subscribers.

In the magazine: Why real assets have become one of the most dynamic opportunities in private markets; Interviews with CBRE Investment Management’s CEO, Chuck Leitner, and head of client solutions, Bernie McNamara; Plus much more…

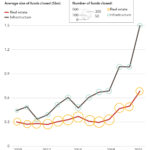

Despite myriad economic shocks over the past decade, GPs have continued closing ever-larger funds as more LPs carve out space for resilient real assets.